Webinar on In-depth discussion on show cause notices under GST

Ranjeet Mahtani, Partner at Dhruva Advisors was part of an illustrious panel in a webinar organised by PHD Chambers on January 31st, 2024. The webinar was an in-depth discussion on show cause notices under GST

India Juris hosted a webinar “Setting up Funds in GIFT City

Angel Fund, FIF, SEZ Compliances & Taxation” on January 25th, 2024Experts from the firm as well as other external key stakeholders of the fund ecosystem took a deep dive to disseminate information about setting up funds in GIFT City. Mr. Mihir Upadhyay, General Manager, IFSCA. Spoke on the overall aspects of “Regulatory Developments of Funds in GIFT City” while Vaibhav Gupta, Partner, Dhruva Advisors LLP spoke on “Structuring & Taxation” and Mr. Sameer Rastogi, Managing Partner, INDIA JURIS put forth the requirements for “Registration of Funds”

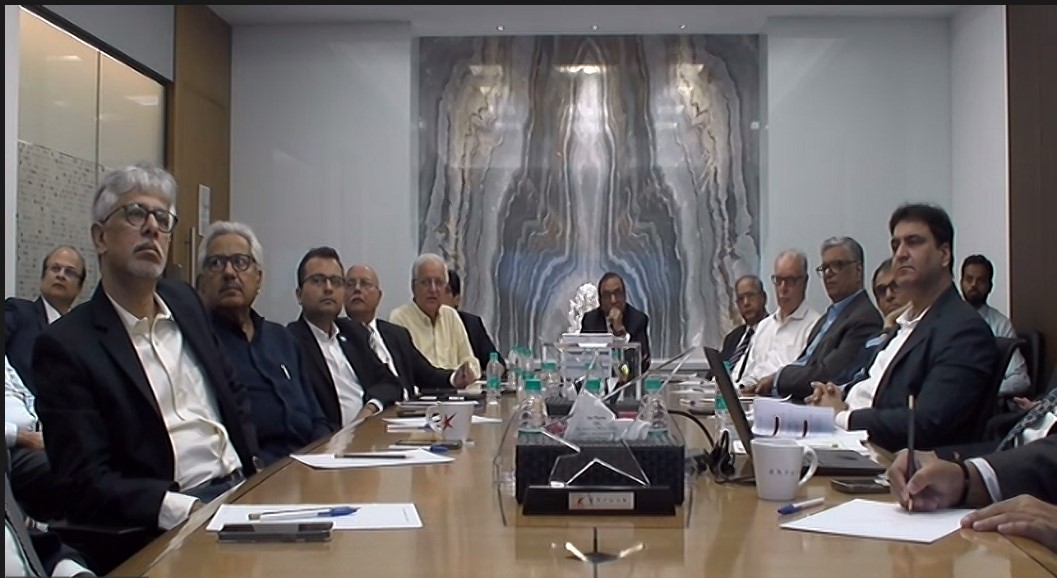

Independent Directors Meet 2023 – Tax Risks and Board of Directors

Any material business decisions and actions taken by organisations, such as implementing a business model, any expansion in India or overseas, diversification, acquisitions, restructuring etc, typically have significant direct and indirect tax implications. If not addressed or planned appropriately, it can pose a significant risk to the organisation in the form of detailed scrutiny and challenges from the revenue authorities, raising of huge tax demands running into hundreds and thousands of crores with a significant impact on the cash flows resulting sometimes into a survival issue for the organisation.

In the last few years, revenue authorities have become extremely aggressive in conducting proceedings such as investigations, searches, surveys etc in an attempt to unearth and tax the transactions which ostensibly in their view are in violation of any laws. Further, both the direct and indirect tax environment have witnessed radical new developments and significant tax litigations requiring the management of the organisation to be aware and keep pace with those developments and adapt their business models and processes.

As a Tax-centric advisory organisation, we hosted a breakfast meet “Tax Risks and Board of Directors” with a select group of independent directors, putting forth our thoughts on these recent developments, the changing tax landscape and tax proceedings as well as the resultant risk mitigation that boards and independent directors need to be aware of and re-calibrate.